Student government to teach students about income, debt, budgeting practices

April 15, 2019

Most college students do not possess the knowledge of knowing how to handle their income, debt and budgeting practices, according to the “Money Management Practices of College Students” study by Reasie Henry.

When it comes to college students, many are not just preparing for life after graduation; they are also budgeting while they are in school.

Zoey White, the chair of the Academic Affairs Committee, said student government is hosting an event entitled How to Beat the Game of Life, where students can learn how to manage their budgeting and finances. She said it would take place in the Alumni Lounge in the second floor of the Martin Luther King Jr. University Union Tuesday from 11 a.m. till 1 p.m.

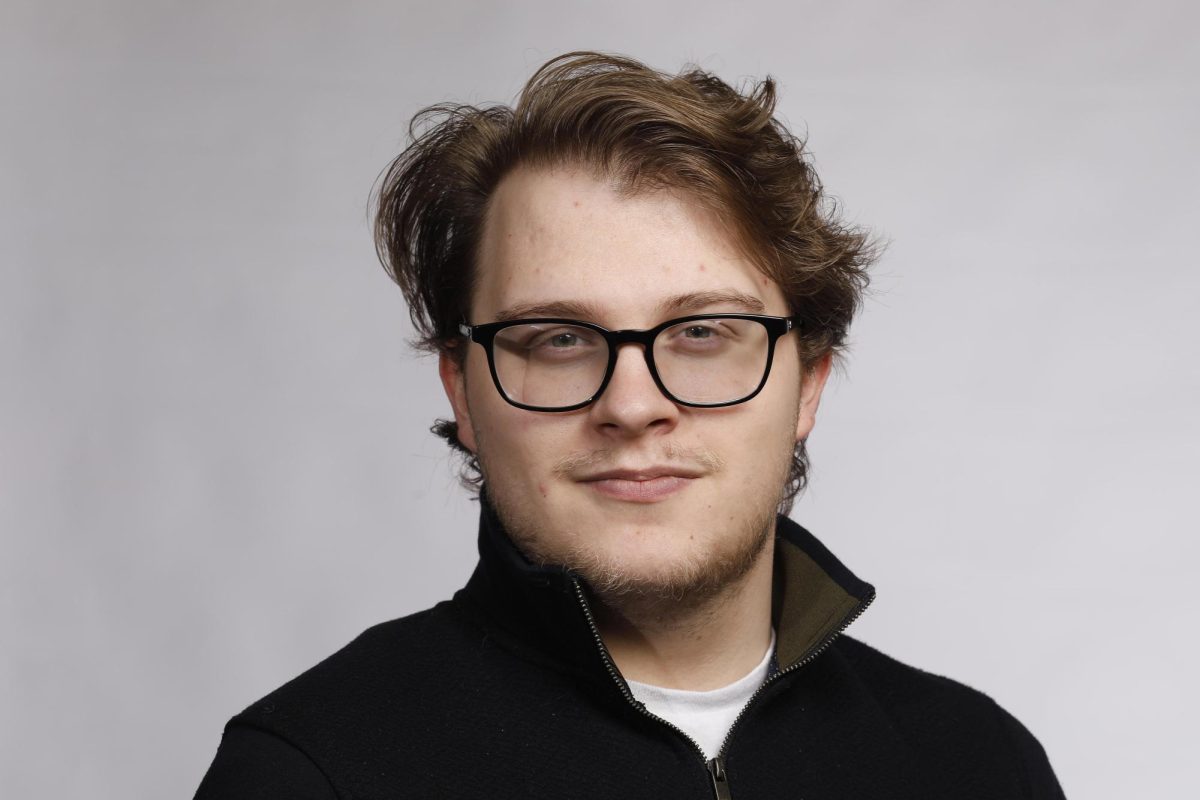

Senator Randall Becker said he helped White structure the concept of the event, using The Game of Life as a motif.

The Game of Life, created by Milton Bradley in 1860 and under the original name “The Checkered Game of Life,” is a board game where people playing can simulate a person’s life experiences with regard to budgeting and finances, according to the National Toy Hall of Fame.

Becker said senators would pass out six informational flyers for six different tables centered on themes of budgeting, such as managing and paying students’ loans or planning where one’s income goes into. At each of the tables, the fliers would go with a budgeting-themed game.

“Our event is more about survival, so again, surviving the game of life,” Becker said. “We have paying bills and rent, and if broken down into percent, I believe it is 30 percent to 40 percent of your paycheck should be going into your monthly rent.”

Beker said people can go about creating a budget in different ways, but students will be most interested in learning about students’ loans since he said it is a “petrifying” thing.

He said most students do not understand how to manage their student loans, which can lead to some fear and confusion. Student debt, however, is not something people should be afraid of; it takes time, but through budgeting, the end amount eventually gets paid, Becker said.

“Couple $10,000 that I am going to own in student debt, and people do not know that it is not that horrible to pay it back,” Becker said. “I mean it is going to be a loan that is on your head; it is not that different from a mortgage, so it is something that everyone needs to suffer until it can push forward.”

Some of the table games White said there would be include The Price is Right, where she said the game would be about guessing how much money certain items cost.

White said information for the event was gathered from Lumpkin College, such as information about financial aid or from Career Services and learning about job requirements and what services they offer.

Becker said senators would hand out pamphlets near the end with more information about different methods of budgeting and websites to reference for help.

Valentina Vargas can be reached at 581-2812 or at vvargas@eiu.edu.

https://www.toyhalloffame.org/toys/game-life

![[Thumbnail Edition] Junior right-handed Pitcher Lukas Touma catches at the game against Bradley University Tuesday](https://www.dailyeasternnews.com/wp-content/uploads/2025/03/MBSN_14_O-e1743293284377-1200x670.jpg)

![[Thumbnail Edition] Eastern Illinois University baseball senior utility player Tyler Castro fields a ground ball during the team's first intrasquad scrimmage of the season on Jan. 31.](https://www.dailyeasternnews.com/wp-content/uploads/2025/03/BB_01_O-e1742874760130-1-e1742907504722-1200x911.jpg)

![[Thumbnail Edition] Senior Foward Macy McGlone, getsw the ball and gets the point during the first half of the game aginst Western Illinois University,, Eastern Illinois University Lost to Western Illinois University Thursday March 6 20205, 78-75 EIU lost making it the end of their season](https://www.dailyeasternnews.com/wp-content/uploads/2025/03/WBB_OVC_03_O-1-e1743361637111-1200x614.jpg)

![The Weeklings lead guitarist John Merjave [Left] and guitarist Bob Burger [Right] perform "I Am the Walrus" at The Weeklings Beatles Bash concert in the Dvorak Concert Hall on Saturday.](https://www.dailyeasternnews.com/wp-content/uploads/2025/03/WL_01_O-1200x900.jpg)

![The team listens as its captain Patience Cox [Number 25] lectures to them about what's appropriate to talk about through practice during "The Wolves" on Thursday, March 6, in the Black Box Theatre in the Doudna Fine Arts Center in Charleston, Ill.](https://www.dailyeasternnews.com/wp-content/uploads/2025/03/WolvesPre-12-1200x800.jpg)