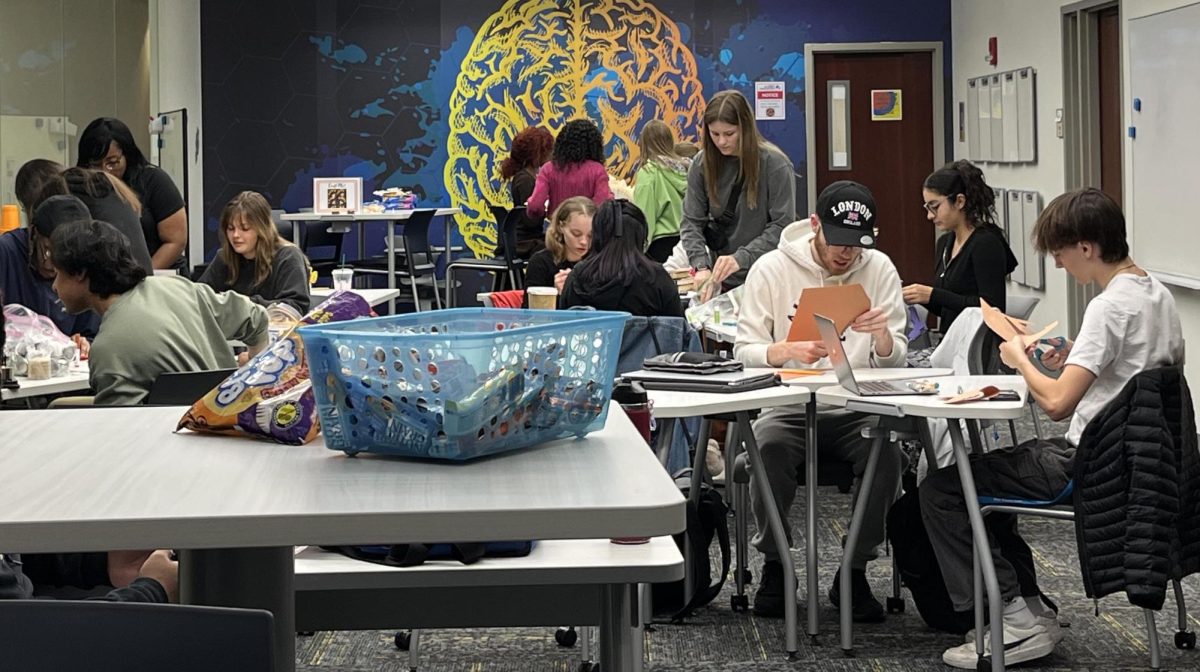

Students make financial decisions

On average, college students spend around $400 every month, with the biggest expense being food.

September 26, 2014

Having little money to spend on living amenities is not uncommon to the average student, but some students have been working to alleviate their burdens by sacrificing things in their life.

Before blacking out during a drive, Austin Haddock, a senior psychology major, would spend $40 a night over a five-day period on alcohol. He said at one point, he spent on average around $150 on alcohol alone.

Haddock has quit drinking ever since that night and become more involved with religion.

“It kind of scared me. I became a Christian after that,” Haddock said.

Haddock said there were many issues going on in his life during that time and his black out made him realize there was a limit and point not to cross. Since that incident, he quit drinking and now hangs out with friends who do not drink.

“It’s too expensive (and) I got burnt out on the whole party scene,” Haddock said.

Now most of his money is spent on food, rent, utilities and dining out, which is about $500 a month with rent and utilities being a little more than half of that.

Haddock said his scholarship handles most of the cost, covering 80 percent of his expenses for tuition and housing, but like many students he also takes out loans to cover the rest.

Since he does not have a job this semester, he generally saves most of his money with the help of his mother.

“I typically try not to spend it all,” Haddock said. “I feel like I do a decent job on my own.”

Morgan Thompson, a freshman communication disorders and science major, said her biggest expense is food at $80.

Thompson said she spends on average $100 a month, and when it comes to food, she buys peanut butter, fruits and water.

In order to afford her expenses, Thompson said she worked a job in her hometown saving money, but her parents also send her money every two months.

Thompson said when she did have her job she would save every paycheck, placing it in her account.

With expenses for students fluctuating between food, alcohol and day-to-day living, one professor was able to give students an advice to budgeting their finances, which can help them in the long run.

Patrick Lach, an associate professor of finance, said the best way students should approach saving is to keep a written record of how much they spend.

Lach was not surprised with the knowledge of hearing how students on average spend more on food.

“It’s one of the things that adds up quick,” Lach said.

Students on average eat around 60 meals a month if breakfast is skipped, if students would save $2 per-meal, they could quickly accumulate $120 in savings, Lach said.

Lach said spending and saving is a lot like weight gain and loss; he said students can either make more money and spend less, or earn less and spend more.

Lach said the important tip to keep in mind is to save money. The most common mistake students make along with poor spending habits is a lack of career planning.

Though some students may not realize it, poor grades and GPA can also lead to not getting the job they want straight out of college. Just graduating may not necessarily be enough because some careers require seeing a GPA on the resume, Lach said.

Lach said saving can be as simple as putting a little bit away over a long period of time, which is highly beneficial. He added if students have $1,440 in savings at 8 percent interest, in 10 years that could easily amount to $20,860.

“That’s a down payment on a house—that’s a lot of things,” Lach said.

Roberto Hodge can be reached at 581-2812, or rlhodge@eiu.edu.