Retirees worry about pension

It has been 15 years since Annie Lee-Jones has put together a lesson plan at Eastern. No longer does she worry about student performance or furloughs. Now, her biggest concern is the dependency of her pension, an important part of her income.

Lee-Jones, an Eastern professor in the department of recreation and leisure studies from 1972 to 1996, has faith in the school that gave her so many good years to take care of her even though she is no longer within its walls.

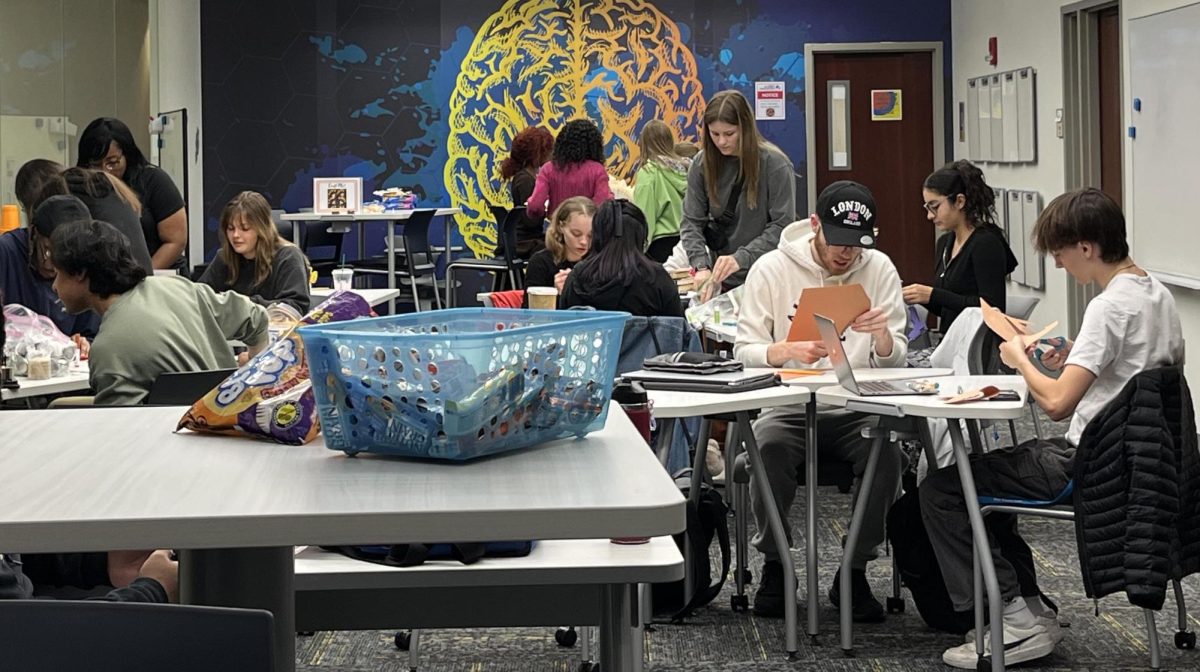

Nick Yelverton, Legislative Director for the Illinois Federation of Teachers, addressed Lee-Jones and fellow former colleagues on ways to do protect the pensions they depend on. Illinois has the worst funded public pension systems in the country as a percentage, Yelverton said.

“There are many people affected by this and (the state) does not want another group of elderly people who are reasonably articulate and destitute,” Lee-Jones said.

Yelverton said there is no money being contributed to the state retirement fund because the general assembly did not act upon pension borrowing legislation before the session ended.

Although state representatives passed legislation that would have allowed the state to borrow $3.7 billion dollars worth of bonds to be able to adequately fund the state university retirement system, they failed to pass the legislation.

One positive aspect that state pensions does have is continuing appropriations, which means the state pension system should have priority when it comes to revenue because it is a continuing obligation of the state, Yelverton said.

Recently, the Illinois Senate proposed legislation that would give the governor the authority to decide how much money to disperse from the fiscal year 2011 budgets to the pension systems. This legislation is currently pending decision.

In 2009, the state owed $450 million to the state retirement system. For 2010, the amount increased to a staggering $702 million from what the state owed for 2009, Yelverton said.

The cause for this major increase may originate from when the state passed the 1995 Funding Law.

“It basically legalized under funding,” Yelverton said.

He said for the first 15 years, the payroll percentage continued to increase, until it reached a level payment plan. Because contribution holidays were taken during the increase, it pushed the liability and the need for those contributions, causing the $252 million gap.

For the fiscal year of 2011, the amount only increased $31 million, a much more manageable state. The money that is now being put forward not benefiting the pension recipients but making up for the deficit from the contribution gaps in the past.

Another legislation that many retirees may not be aware of is the Government Pension Offset of 2008.

This counts for if an individual is not receiving social security benefits, but their spouse is eligible. When the spouse passes away, they are not entitled to the full part of their survival benefits, according to the bill.

“A widow tax, as I like to refer to it,” Yelverton said. “Retirees usually do not learn about this until their spouse passes, which is the most vulnerable and needy times the government pension offset hits them.”

The majority of retirees who attended the presentation were once a member of the Eastern faculty and are concerned about their futures.

John Allison, Eastern’s representative on the executive board of the Universal Professionals of Illinois, wanted to make sure that attendees walked away with a stronger sense of certainty about their futures.

“It’s heartening to hear people represented from different groups, like the State University Annuitance Association, University Professionals of Illinois and other organizations talking about coming together because we’re all affected by this,” Allison said. “It’s extremely important for everyone to know that most of the people were talking about won’t be eligible for social security. They’re under tremendous economic threat.”

Audrey Edwards, retiree chapter chair of the Eastern branch of Illinois Federation of Teachers, was responsible for organizing the event. Last April, Edwards attended Lobby Day in Springfield with fellow members of the UPI. Edwards was impressed by the unity of the struggling professionals.

“It was so dramatic to me to see that there are so many public teachers and state employees who are willing to join together to make greater numbers,” she said.

What Edwards proposes is that it may be effective for those enduring the pension crises to join numbers with state employees.

She said if Eastern does not have a proper pension system in place, it will also affect the ability for the university to hire and maintain faculty.

The pension crises not only will have a dire effect on future and current Eastern retirees, it may also affect the students if not resolved.

Alan Baharlou, an emeritus geology/geography faculty member from 1980 to 2005, argued that if faculty members become overwhelmed by the pension crises, it might reveal itself in the classroom.

“When we say, ‘We Are EIU,’ it’s about people,” he said. “We need to take care of our people.”

Shelley Holmgren can be reached at 581-7942 or meholmgren@eiu.edu.

Retirees worry about pension

Nick Yelverton, Legislative Director for the Illinois Federation of Teachers, speaks to colleagues on ways to protect the pensions they depend on. (Seth Schroeder