Students concerned about tax increase

Illinois residents need to think twice from now on before buying an ice cold Bud Light or indulging in a sweet treat from now on.

A 6.25 percent tax increase on candy and soft drinks and a 25 percent tax increase on beer was implemented Tuesday.

Higher taxes were placed on cigarettes, wine, liquor and personal hygiene products as well.

The tax increase is an effort from Gov. Pat Quinn in hopes of paying for construction projects ranging from new roads and bridges, to new schools. This construction plan was set into motion to try and boost the Illinois economy.

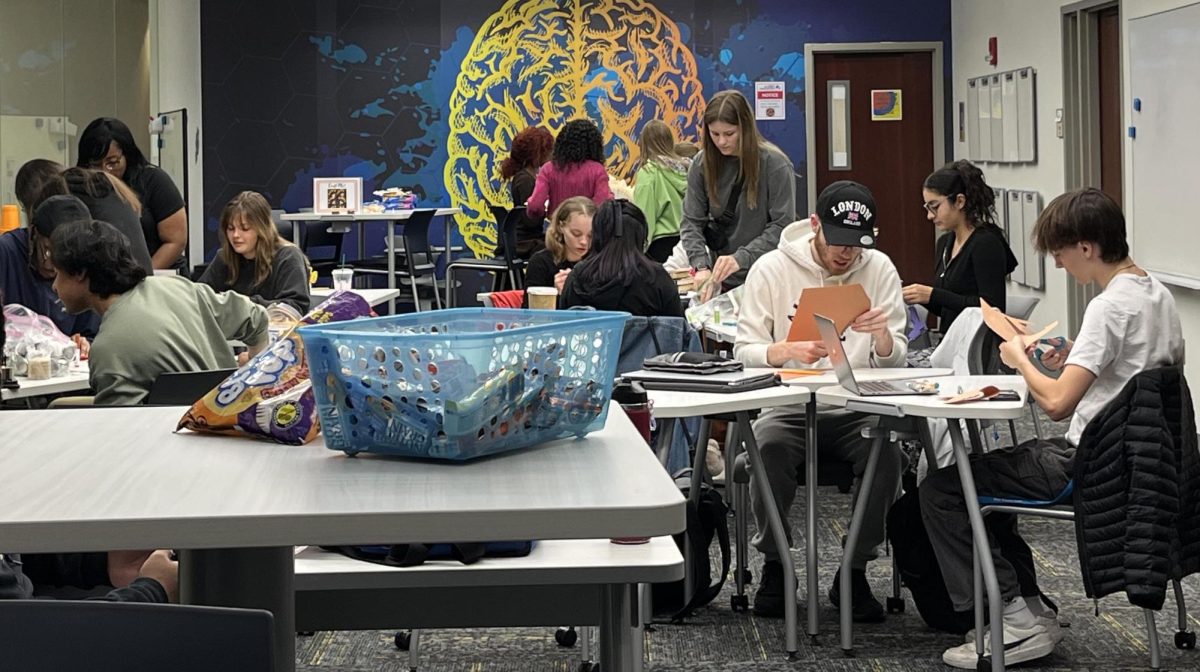

Students at Eastern voiced their concerns on the increases.

“I think it’s pretty stupid,” said Mega Givens, junior elementary education major. “Candy is a pretty trivial thing.”

Givens’ candy of choice is sour Skittles.

“I am kind of addicted to them and now I can’t buy them everyday like I used to,” she said.

Givens also said she will not be able to afford buying candy anymore since she said she will not be able to afford it.

“I am a college student and college students are generally poor,” she said.

Candy will now be taxed at a state rate of 6.25 percent, along with soft drinks and hygiene products.

Another student was not surprised about the tax increase on candy.

“Candy is probably a steady increase anyway so I am not really surprised by it,” said Landon Hines, sophomore business education major. “I will probably still buy candy as long as it is not an over the top price, but a reasonable one.”

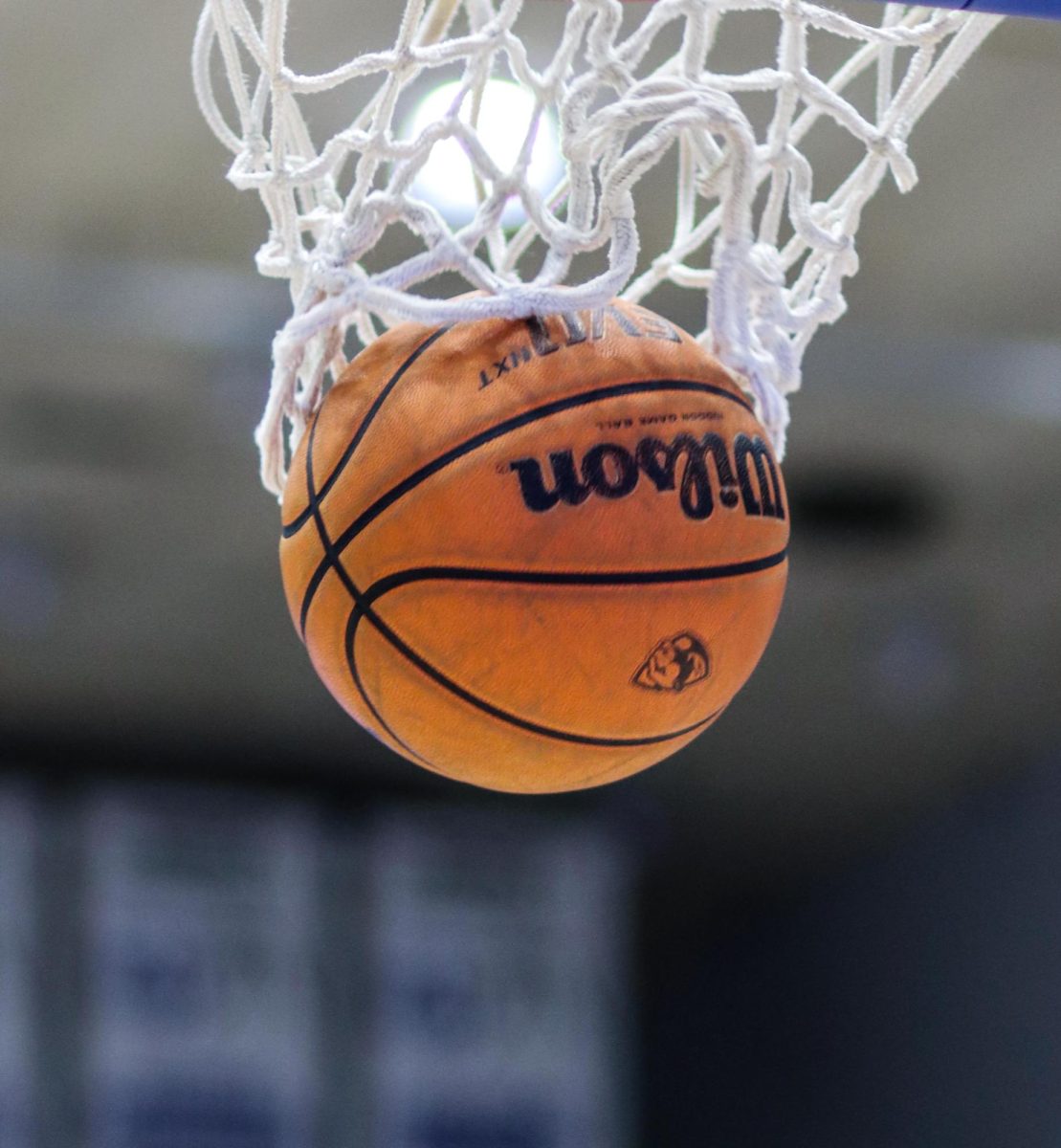

The Illinois Department of Revenue spokeswoman, Sue Hofer, said alcohol distributors will now pay an excise tax of about 2.6 cents more for a six-pack of beer, 13 cents for a bottle of wine and 81 cents for a fifth of hard liquor.

Nick Liefer, senior English major, is upset over the tax increase in beer more than the candy increase.

“I am mad that the beer went up,” he said.

“I drink a lot of beer.”

Some students said the increases did not really affect them,

Shaun Billman, a post-baccalaureate student in middle school elementary education, said he usually indulges in candy, beer or liquor once or twice a month.

“Now it will have to be once every couple of months,” he said. “I haven’t been buying much candy and alcohol lately and I guess I’ll be buying even less since a dollar won’t stretch as much.”

Amanda Bosco, sophomore early education major, said neither tax increase really affected her either.

However, she agrees with the tax increase on beer.

“They should do a higher tax on beer because it makes people aware of how much they should be drinking,” she said.

Heather Holm can be reached at 581-7942 or at haholm@eiu.edu.

Students concerned about tax increase

We live in a society that is driven by industry and fueled by technology. The need to conserve and reduce waste will only continue to grow.